The Enterprise Wide Risk Assessment (EWRA) is the foundation of your AML program. Ministry of Economy inspectors in 2025 use advanced tools to identify "copy-paste" compliance manuals. Using a generic template is often viewed as worse than having no manual at all, as it implies willful negligence.

The "Template Trap"

If your risk assessment mentions products you don't offer (e.g., "Wire Transfers" for a Real Estate Broker) or geographic risks you don't face, auditors will flag it as "Effective Non-Compliance". This often triggers a deeper, forensic audit of your files.

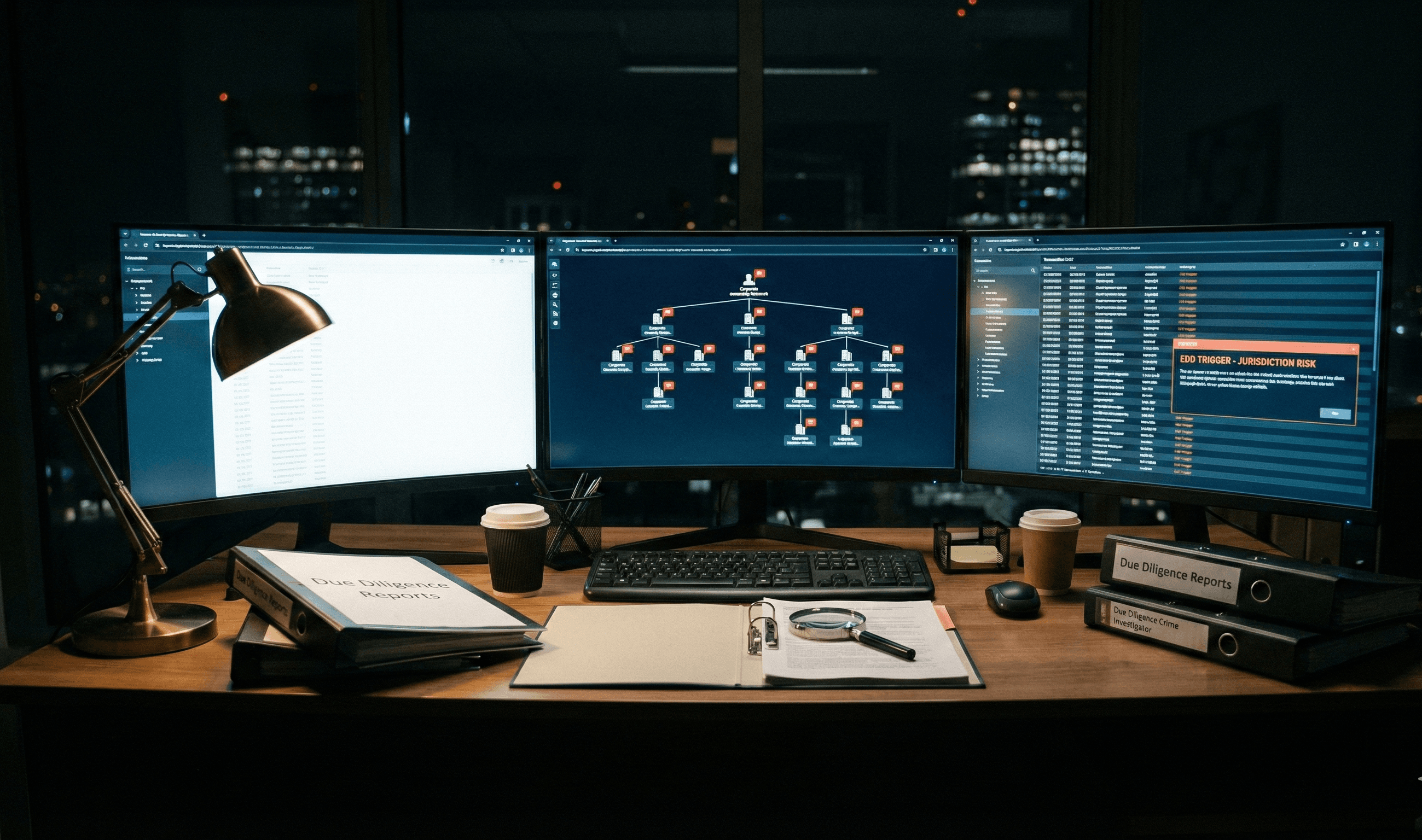

Audit Red Flags:

- Static Scoring: Marking all risks as "Medium" without justification.

- Missing Methodology: Failing to explain how you calculated the risk score (Likelihood x Impact).

- Zero Suspicion: Considering a risk assessment "complete" while having 0 STRs filed in 3 years.

What Must Be Customized?

- Customer Types: Do you deal with Non-Residents? Trusts? Offshore companies? Each carries a different risk weight.

- Geographic Risk: You must analyze your transactions. If 40% of your buyers are from a specific high-risk jurisdiction, your EWRA must reflect that high residual risk.

- Delivery Channels: Do you meet clients Face-to-Face or is it all digital? Non-face-to-face business requires stricter controls.

Author: Zeej Strategic Consulting Research Team