Due Diligence

Know Your Customer with Confidence

Risk-based due diligence for customer onboarding & monitoring. thorough assessments using risk-based approaches.

Deep Dive Due Diligence

Our specialized team conducts thorough KYC, CDD, and EDD reviews. We don't just tick boxes; we analyze the risk profile of each customer, ensuring you understand who you are doing business with and preventing financial crime risks.

Execution Roadmap

A structured, transparent journey from initiation to delivery.

Data Collection

Gathering ID, corporate docs, and UBO information.

Identity Verification

Authenticating documents against official registers.

Screening

Running names against sanctions, PEP, and adverse media lists.

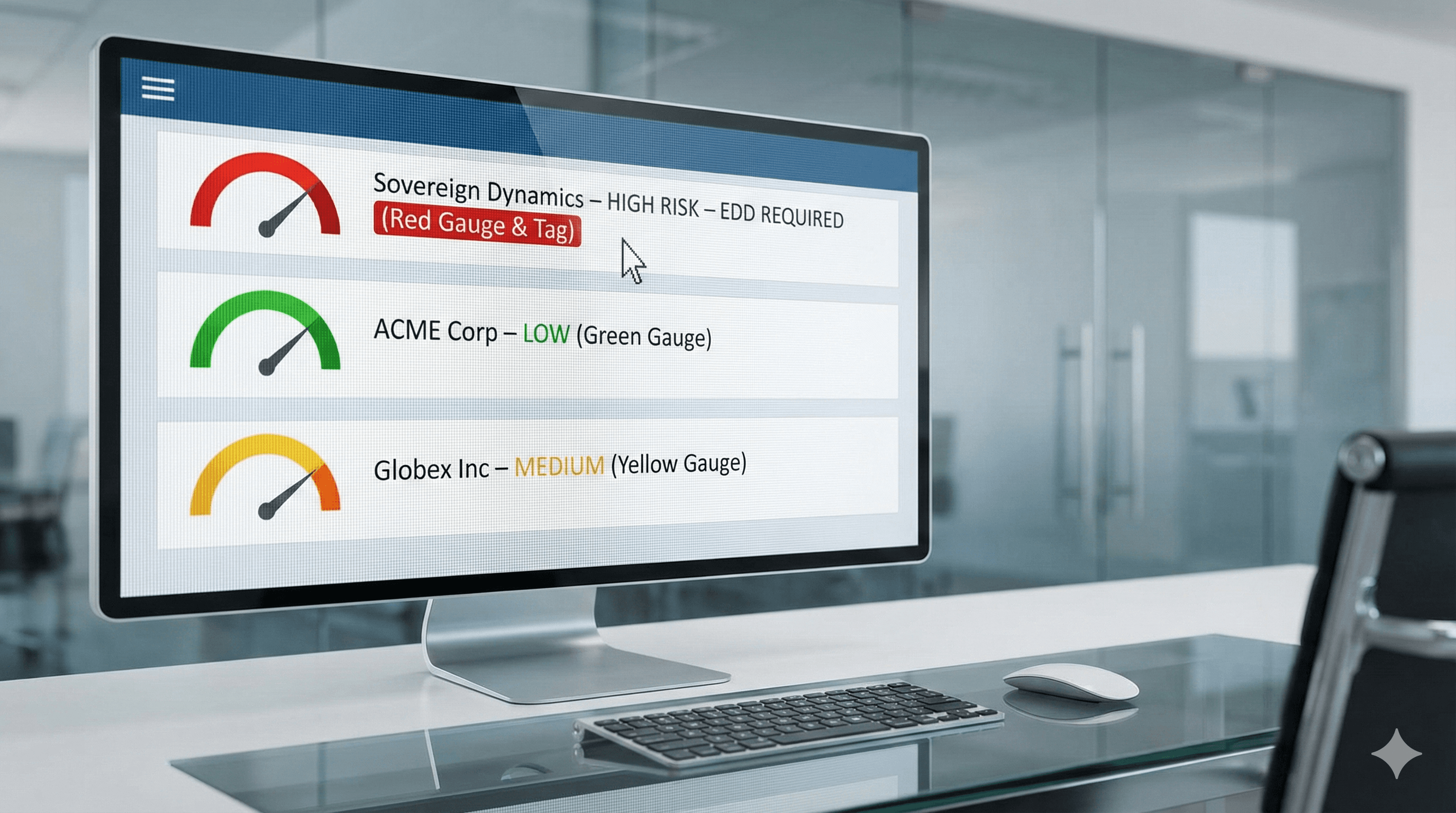

Risk Scoring

Calculating initial risk rating based on dynamic factors.

Enhanced Due Diligence

Deep-dive research for high-risk or complex entities.

Source of Wealth

Verifying origin of funds and wealth for high-risk cases.

Compliance Approval

Final review and sign-off by compliance officers.

Ongoing Monitoring

Setting periodic review schedules and trigger events.

Key Features & Benefits

Risk-Based Screening

Tailored screening depth based on customer risk profile.

UBO Identification

Unraveling complex corporate structures to find ultimate owners.

EDD Reports

Detailed intelligence reports for high-risk relationships.

Ready to Elevate Your

Due Diligence?

Join the industry leaders who trust Zeej Strategic Consultancy for their compliance needs.

Book a Consultation