Risk Assessment

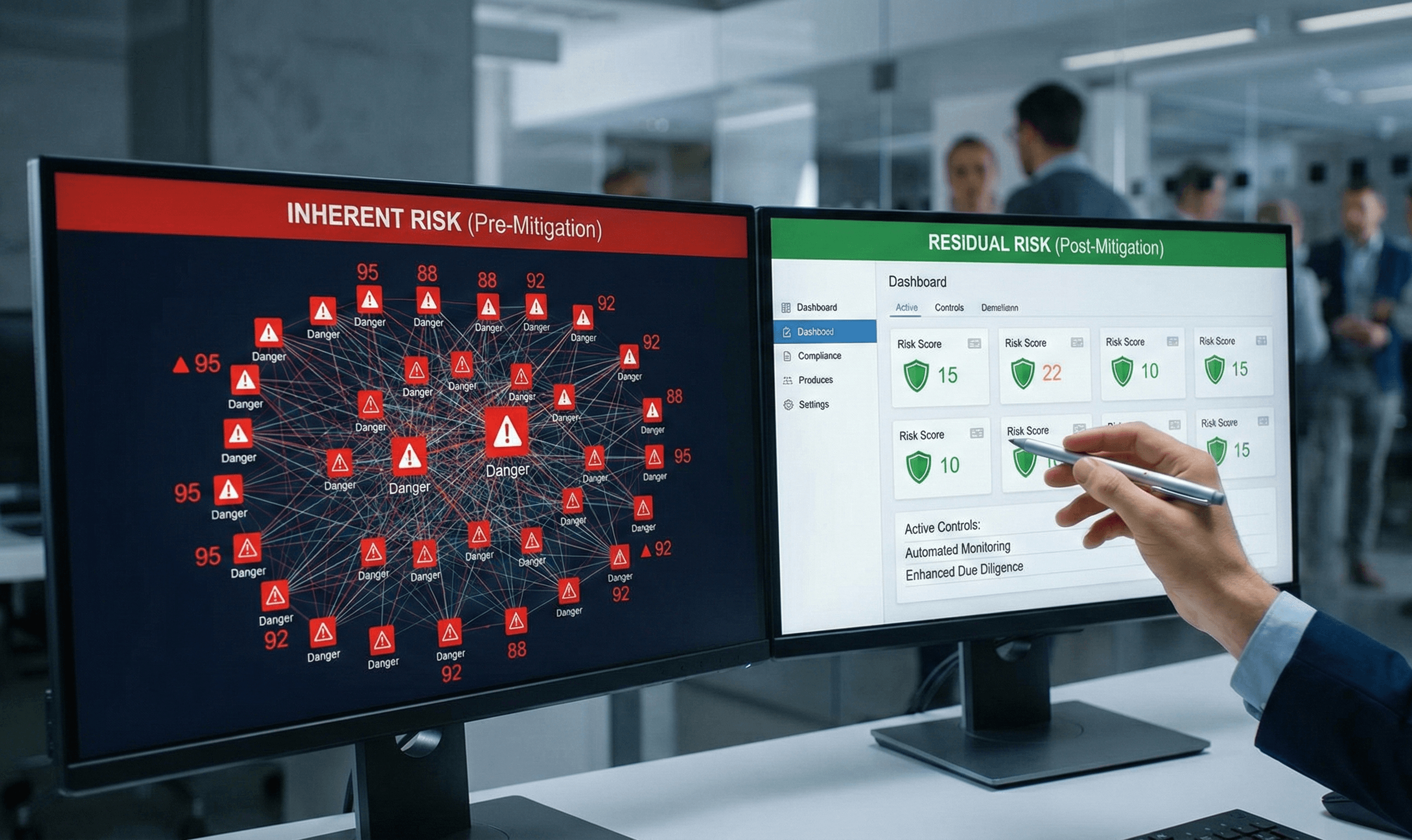

Holistic Risk Visibility

End-to-end inherent & residual risk assessment methodology. Comprehensive evaluation of money laundering and terrorist financing threats.

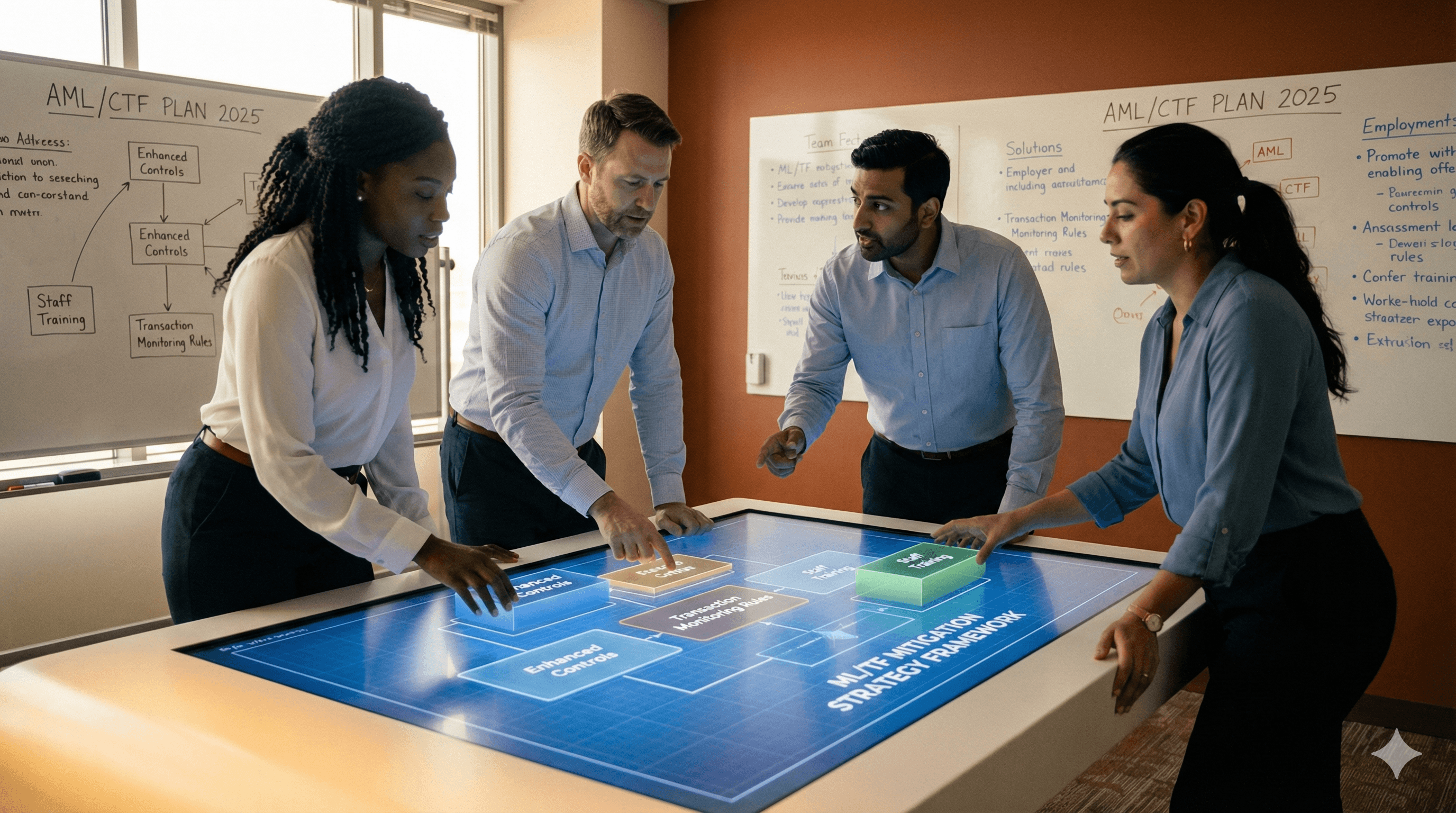

Identifying and Mitigating Threats

An Enterprise-Wide Risk Assessment (EWRA) is the cornerstone of any AML program. We help you identify inherent risks across customers, products, channels, and geographies, and evaluate the effectiveness of your controls to determine residual risk.

Execution Roadmap

A structured, transparent journey from initiation to delivery.

Context Establishment

Defining the scope and context of the organization.

Inherent Risk ID

Identifying risks in customers, products, and channels.

Data Analysis

Reviewing transaction volumes and customer demographics.

Control Inventory

Mapping existing controls to identified risks.

Control Testing

Evaluating the design and effectiveness of controls.

Residual Risk Calc

Determining net risk levels after controls are applied.

Action Plan

Developing mitigation strategies for high residual risks.

Board Approval

Presenting findings and heatmap to the Board/Senior Management.

Key Features & Benefits

Custom Methodology

Tailored risk scoring models specific to your industry.

Heatmaps

Visual representation of risk concentrations.

Regulatory Alignment

Ensuring the assessment meets specific UAE/CBUAE requirements.

Ready to Elevate Your

Risk Assessment?

Join the industry leaders who trust Zeej Strategic Consultancy for their compliance needs.

Book a Consultation